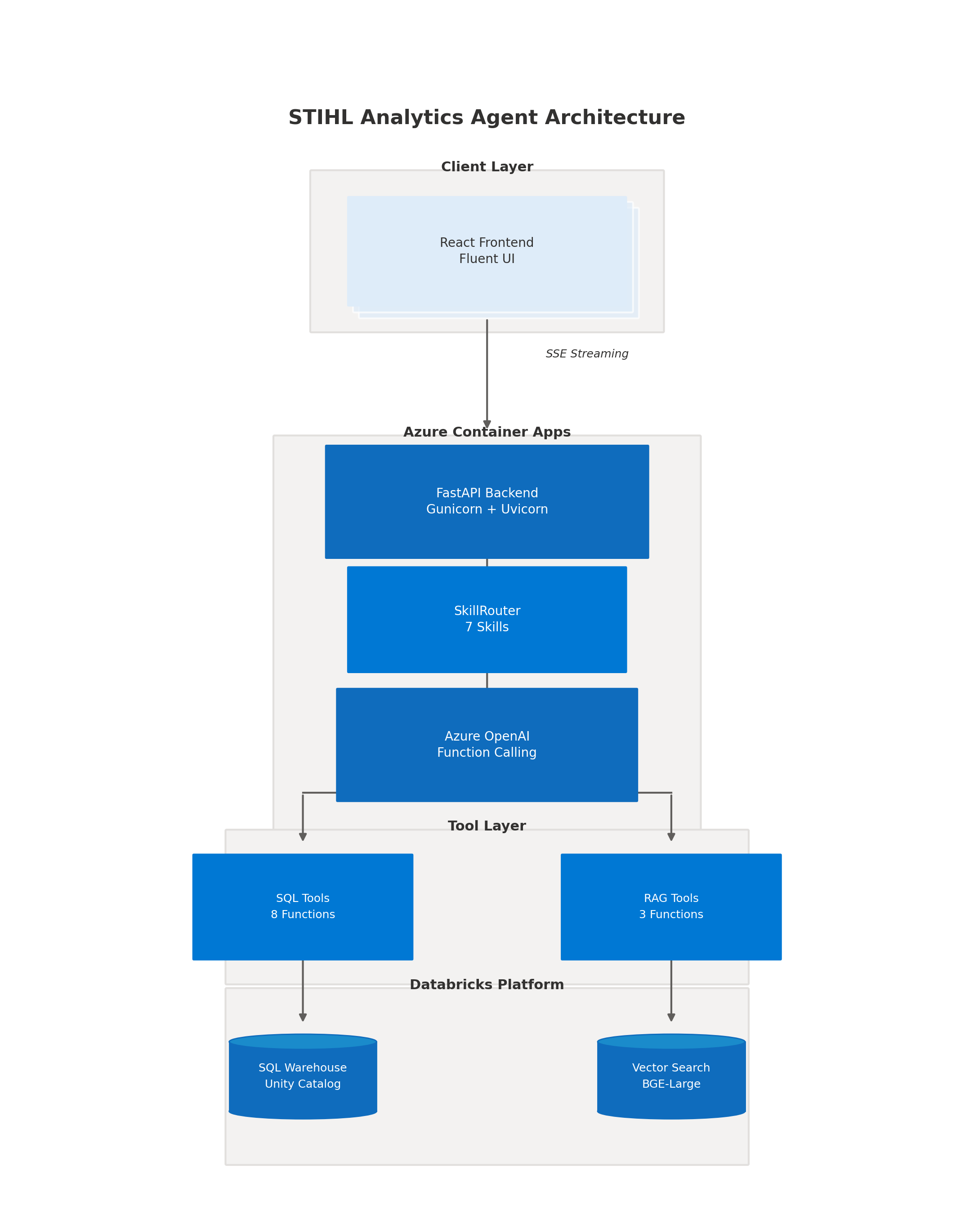

Technical Architecture

A modular, skill-based architecture designed for enterprise deployment, extensibility, and governance.

Data Layer

Medallion architecture (Bronze/Silver/Gold) with Unity Catalog governance and Vector Search for semantic queries.

Intelligence Layer

Skill Router with 8 specialized skills, confidence-based routing, and context-aware tool selection.

Interface Layer

Natural language processing with streaming responses and multi-turn conversation support.

Eight Specialized Skills

Each skill is purpose-built for a specific analytics domain, with dedicated prompts and tool access.

| Skill | Purpose |

|---|---|

| Insights Advisor | Proactive alerts, anomaly detection, daily briefings |

| Sales Analyst | Revenue, units, transactions, performance tracking |

| Inventory Analyst | Stock levels, stockout risk, supply analysis |

| Dealer Analyst | Network performance, coverage, territory analysis |

| Forecast Analyst | Projections, seasonal patterns, run rates |

| Trend Analyst | YoY/MoM comparisons, growth analysis |

| Product Expert | Semantic search, recommendations (RAG-powered) |

| Replenishment | Shipment request coordination |

Data Sources Supported

Connects to your existing data infrastructure without requiring data migration.

Azure Data Lake Storage (ADLS)

Connect to raw and processed data files in your data lake.

OLTP Databases

Access transactional systems via Databricks connectors.

Enterprise Data Warehouses

Synapse, Databricks SQL, and Snowflake compatible.

Unity Catalog

Governed metadata with fine-grained access control.

Your Cloud. Your Data. Your Control.

Designed for deployment within your existing cloud infrastructure.

Container-Based

Deploys to Azure Container Apps or your preferred container platform.

Existing Infrastructure

Connects to your existing Databricks SQL Warehouse.

No Data Egress

All processing happens within your security perimeter.

Identity Integration

RBAC via Azure AD / Entra ID for seamless authentication.

Sample Interactions

Natural language conversations that surface actionable insights.

Good morning! What should I know today?

Good morning. Here are three items requiring attention: Southwest sales dropped 12% WoW, two warehouses show low inventory on your top SKU, and dealer performance in the Midwest is trending below forecast. Would you like details on any of these?

Show me our top performing dealers in California

Here are your top 5 California dealers by revenue this quarter: Pacific Power Equipment leads with $2.4M (+18% YoY), followed by Bay Area Outdoor at $1.9M. I notice two dealers have improved their ranking significantly. Should I compare their strategies?

Are there any inventory risks I should know about?

Yes, I've identified 3 products with stockout risk in the next 14 days: MS 261 C-M (only 45 units, 8 days supply), TS 440 (32 units, 6 days), and BR 800 C-E (28 units, 5 days). Would you like me to prepare a replenishment request?

Ready for a technical discussion?

Available for architecture review, technical walkthrough, or pilot evaluation.